Disclaimer: The following article is from “Toy Frontiers.” Author: “Toy Growth Secrets.”

Recently, the Mother and Baby Industry Observations, in conjunction with the Mother and Baby Research Institute, which focuses on market research in the mother and baby sector, released the 2024 Plush Toy Brand TOP 10 Power List. The list evaluates the commercial value of each brand across five dimensions: brand power, product power, channel power, organizational power, and purchasing power. By assigning different weights to each dimension, a comprehensive score is calculated to determine the rankings. Here is the specific list:

With the continuous explosion of the emotional economy, the plush toy market has ushered in a new round of growth. According to Magic Mirror Insights data integrating Tmall and Taobao platforms, the market size for plush/dolls/figures/fabric toys reached 4.24 billion yuan in 2024, an increase of 8.4% year-over-year.

At the same time, data from the enterprise information checker Qichacha shows there are 17,700 existing plush toy-related enterprises in China. As of December 5, 2024, 1,392 plush toy-related companies have been registered, with 1,376 registered in the first 11 months, an increase of 15.05% year-over-year.

With many players gathering in the plush toy market, which brands have become the new traffic magnets? What lessons can their development paths teach newcomers?

The Addiction of Young People: JELLYCAT

Ranked TOP1 on the list is the British plush toy brand JELLYCAT. With its soft touch, IP anthropomorphism in design, and precise scarcity marketing, it has won the hearts of young consumers in the Chinese market. JELLYCAT also continuously introduces new products, with over 200 new products each year, spanning a wide variety from animals to plants, to food, to daily necessities, meeting the consumption preferences of different audience layers.

More importantly, for the seeding part that causes headaches for most brands, many consumers voluntarily carry JELLYCAT IP plush dolls, such as the Barcelona bear, penguin, Bonnie bunny, lively eggplant, eyemask owl, and rainbow cake, to various attractions to check-in. Based on the anthropomorphic attributes of JELLYCAT dolls, they create a series of expressive content, triggering emotional resonance among consumers on social platforms and forming spontaneous sharing, which helps the brand rapidly penetrate various circles.

For JELLYCAT, success lies not only in the excellence of the product but in pivoting the brand with IP + emotional value, becoming both a “healing tool” for young consumers and a “social currency” for them.

Based on the advantages mentioned above, JELLYCAT’s performance is envied by its peers. The 2023 fiscal data showed that JELLYCAT’s revenue was 200 million pounds (approximately 1.85 billion yuan), a year-over-year increase of 37%; gross profit reached 130 million pounds (approximately 1.2 billion yuan), a year-over-year increase of 46%.

However, JELLYCAT’s popularity is not accidental. If you’ve been on various social platforms, you might notice plush toys like Disney celebrities Lena Belle and Star D’Luna, or IKEA’s morose but cute Broccoli shark, which do not have storied IPs, are also highly sought after by young people. The plush toys themselves, with their soft touch, can help consumers release stress and anxiety, offering an emotional outlet precious to young folks.

Pop Mart Left, Miniso Right

With steady growth in the plush toy market, many toy enterprises and retailers are also seizing the opportunity to explore new growth secrets. For example, Pop Mart has achieved commendable success in grabbing a slice of the plush toy market pie. Data from the first half of 2024 showed that revenue growth for plush toys was the fastest, increasing by 993.6% to 446 million yuan. Initially, Pop Mart entered the plush toy race with its silicone plush toy Labubu, and user feedback was that “the doll smiles genuinely,” it’s “healing,” and “the more you look at it, the cuter it gets.”

Labubu, from designer Jason Freeny’s THE MONSTERS, looks a bit malevolent but is a lively and courageous, cute, optimistic member of the forest. The success of Labubu’s silicone plush not only helped Pop Mart knock on the doors of the plush market and Southeast Asia but also drove its own brand premium. On a secondary trading platform, a box of Labubu Party silicone plush series, originally priced at 594 yuan, was flipped for thousands of yuan.

However, unlike Pop Mart, which revolves around its own IP in developing plush toys, Miniso excels in plushifying hot IPs in the market. In the first three quarters of 2024, Miniso’s plush category reached a global sales volume of 36 million units, which is very significant. It is understood that Miniso introduces over 10,000 new IP products each year and has established cooperative relationships with over 150 globally known IPs, including Pokémon, Harry Potter, Sanrio, My Little Pony, Disney, Barbie, Chiikawa, and more.

It’s worth mentioning that Miniso has announced that this year it will launch the mini plush series of silicone plush products co-created with Disney, continuously updating its plush product line. As the overseas business of both Pop Mart and Miniso continues to develop, the categories they compete in are also becoming increasingly rich.

Wentongzi and Chongker’s Plush Toy Business

After the plush toy boom, whether to follow the path of JELLYCAT or find one’s way has become a collective contemplation for practitioners. Let’s first look at Wentongzi, which initially focused on the car accessory market with its first pot of gold coming from the “One Deer Peace” bamboo charcoal doll.

During its development, Wentongzi discovered that integrating traditional Chinese culture with trendy design better showcases Chinese cultural characteristics and increases brand recognition. For instance, Wentongzi’s “Art Buddy · The Fisher” is based on a cormorant, inspired by the image of a lone fisherman in a straw raincoat and hat fishing in the cold river snow; the “Little Demon” series with “Buboy the Buffer,” “Black Bear Spirit,” and “Turtle Prime Minister,” among others, are creative takes from “Journey to the West;” while “Fox Faux-Tiger Power,” “Dumb as a Wooden Chicken,” and “Fool Bug Ornament” are inspired by Chinese idioms.

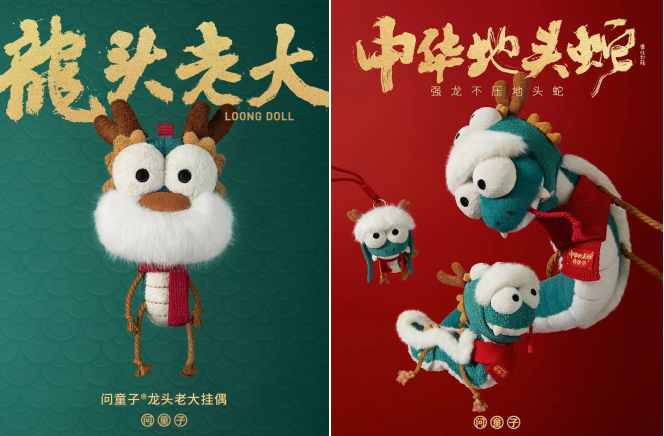

Furthermore, designing plush toys for the New Year is a hotly contested area for sellers. Last year, the company launched the blockbuster “Dragon Head Boss,” and this year, it introduced the Chinese local snake series, like “The Strong Dragon Doesn’t Bully the Local Snake,” priced at 329 yuan. Besides, to meet a more diverse range of audience needs, Wentongzi also offers services for changing the clothes of dolls, continuously exploring more possibilities in the plush toy business.

Chongker Simulated Petsaims to provide consumers with realistic pet and animal toys, covered categories include pets and animals, with features including semi-realism, custom realism, intelligent simulation, and more. Simply put, it offers realistic pet dogs such as Huskies and Border Collies, as well as pet cats like Golden Layers, Calico, and Cow Cats, for those who love pets but can’t keep them.

In addition to plush pet dolls, Chongker has also launched plush accessories, realistic pet backpacks, intelligent AI pets, and other categories. In the seemingly blue ocean of the plush toy market, most enterprises leverage the market’s popular IPs to give their brands more volume and recognition, but the newcomer Chongker directly engages in the business of realistic pet “alternatives” for young people, strongly emerging as a dark horse in the scene.

Summary

Overall, the plush toy market shows new consumption trends such as IP-ization, realism, and AI-intelligent. Focusing on the domestic market, although more and more brands are rushing into the plush race, the market is still in a “category-rich but brand-poor” state, with no company running to the front like plush toy JELLYCAT or brick toy LEGO. However, under the backdrop of the emotional and healing economy, a batch of distinctive and promising newcomers has emerged, marking a good beginning.

Keywords:

1. CBME 2025 children’s toys and games

2. CBME 2025 wholesale baby merchandise