The consumption power of women in the market should never be overlooked. She-economy is endowed with inherent conditions of high consumption willingness and paying capacity. Even when consumption slows down, there are still high-potential business opportunities in the subdivided niches. So, what are the niche markets for female consumption that are yet to be explored? Which subdivided categories with high growth potential should people try? And how competitive are those categories?

To answer these questions, we conducted a deep analysis of female consumption categories on TikTok, focusing on three sectors: beauty and skincare, body care, and maternity products. We discovered seven high-growth niche categories, and here’s the summary of our findings:

- Beauty and Skincare: Women’s attention to facial care and makeup is becoming more refined, with the lip essence market growing at a rate of 21.1%. Consumer awareness of this category is still in its infancy, and new brands have the potential to break through based on their product strength. The false eyelash market is also large and growing rapidly, and there is still room for further segmentation and iterative upgrades based on consumer needs.

- Body Care: The growth rates of foot bath agents and hair care essential oils have both exceeded 80%, and the private care market is growing at a rate exceeding 70,000%. The number of products in the private care market is growing exponentially, with overseas brands dominating the top positions, but domestic brands are rapidly capturing market share with high growth rates.

- Maternity Products: The year-on-year growth rate of pregnant women’s pants is nearly 100%, and the growth rate of facial essence for pregnant and postpartum women exceeds 7000%. The facial essence market for pregnant and postpartum women is still in its infancy, with a small number of brands and low competition. Brands can start with facial essence and gradually extend to other maternity skincare products.

Beauty and Skincare

Lip Care

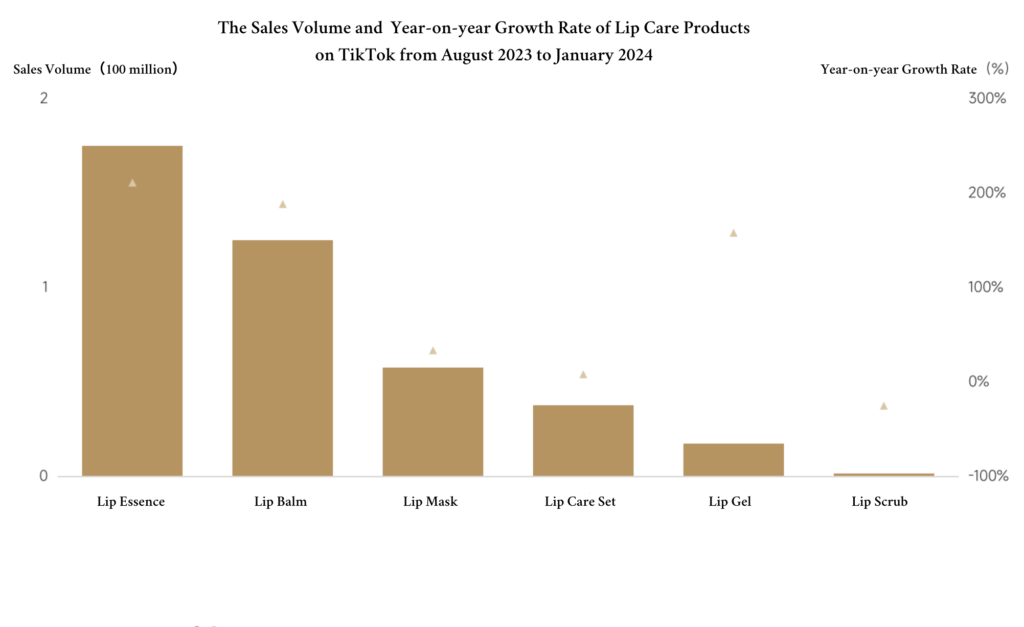

From August 2023 to January 2024, sales of lip care products on TikTok exceeded 500 million RMB, with a year-on-year growth rate of 133.6%, far surpassing the 58.2% growth rate of the overall skincare market.

Female consumers are paying more attention to fine lip care, giving rise to various subdivisions based on texture, form, and function. Lip essence is the largest and fastest-growing subcategory, with sales of nearly 200 million RMB and a year-on-year growth rate of 211.2%, higher than the overall growth rate of TikTok.

In January 2024, the number of brands in the lip essence market reached 200. The top 5 brands accounted for 62.76% of overall market share. There is not one brand which is dominating the market yet. Consumer awareness of the lip essence category is still in its early stages. New brands still have the potential to become market leaders.

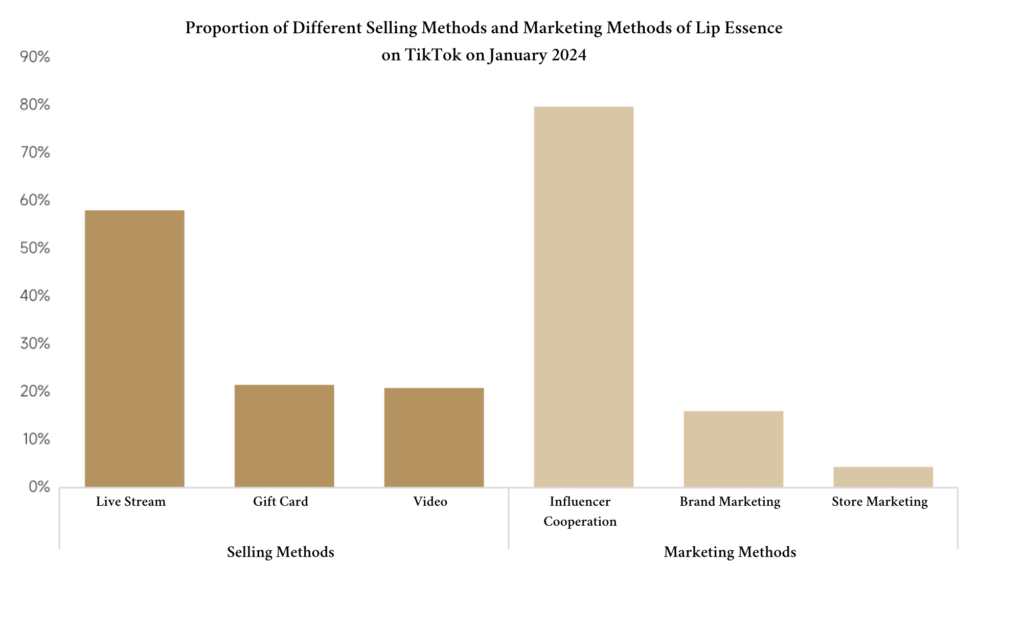

Currently, lip essence sales are mainly driven by live streaming, with influencer collaborations accounting for 79.7% of sales.

Leveraging the popularity of anchors and influencers can drive category exposure and broaden the audience. For emerging brands, KOLs and KOCs can help establish brand reputation through effective KOL momentum accumulation.

False Eyelashes

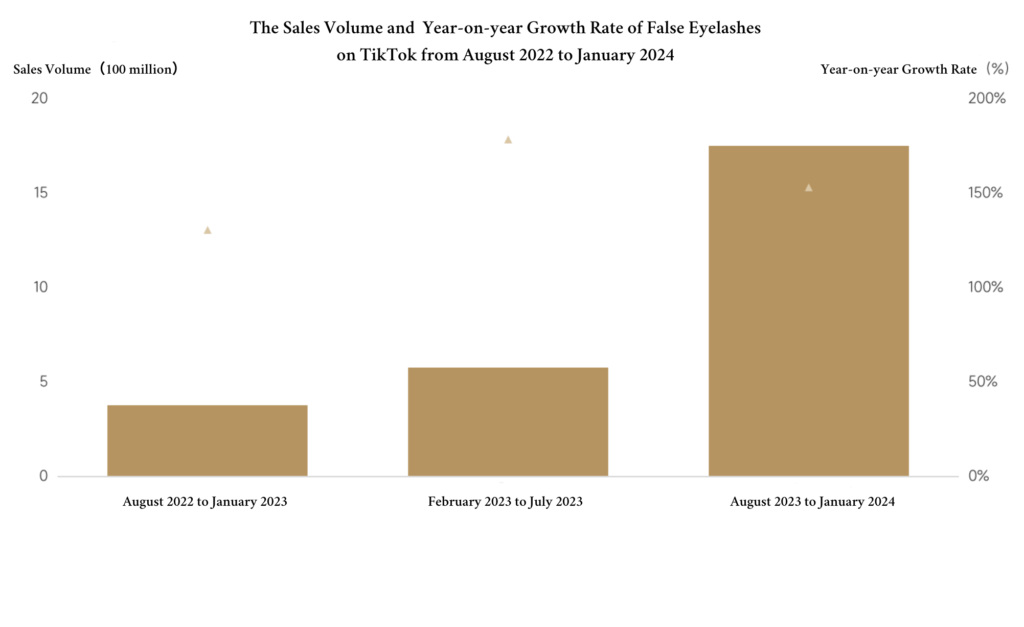

Eyelashes have always been a favorite of beauty enthusiasts, serving as the finishing touch to the makeup look. From August 2023 to January 2024, sales of false eyelashes on TikTok exceeded 1.5 billion RMB. Its a year-on-year growth rate is 153.1%.

Huge consumer demand is driving the continuous growth of the sales of false eyelash. While the false eyelashes market is already sizeable, there are constantly subcategories of false eyelashes emerging in the market.

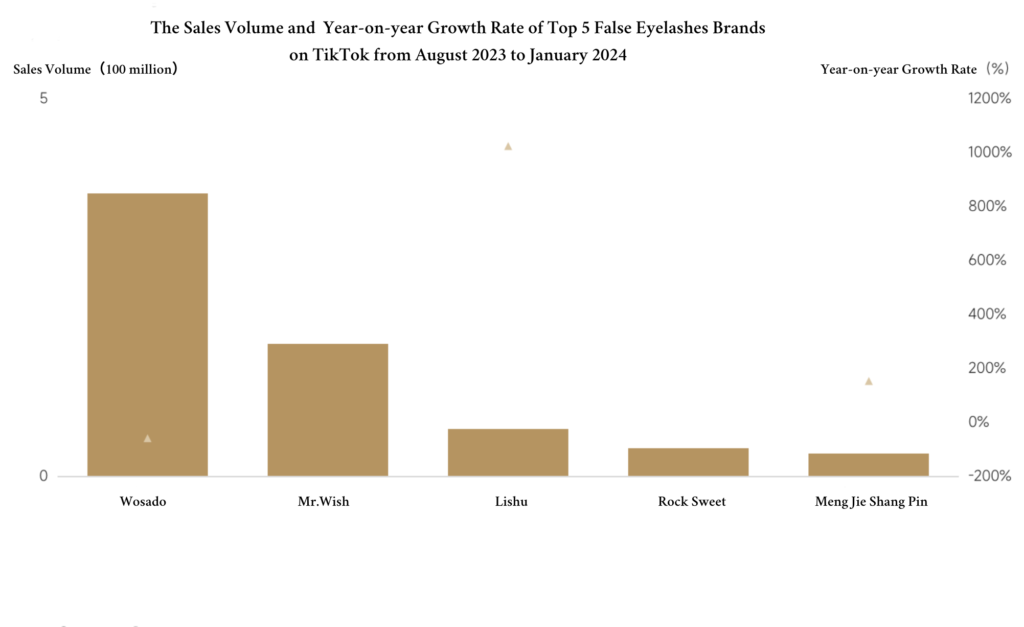

It can be mainly divided into 3 subcategories: ordinary false eyelashes, magnetic false eyelashes, and glue-free false eyelashes. Among the top 5 brands in the false eyelash market, Yue Tong, represented by magnetic false eyelashes, ranks first.

The innovativeness and functionality of its magnetic false eyelashes have made the price for one piece over 100 RMB. But because of new players and low cost-effectiveness have caused a decline in sales of Yue Tong.

Mr.Wish and Lishu have gained popularity with innovative styles that complement current fashion trends and convenient. Rock Sweetheart has become the forefront of the market with its more easy-to-use glue-free false eyelashes.

With low entry barriers and high consumer demand, the growth prospects of the false eyelash category are quite promising. While some existing brands have already established strong category recognition, new brands can still capture a certain market share by innovating their products based on consumer needs.

Body Care

Private Care

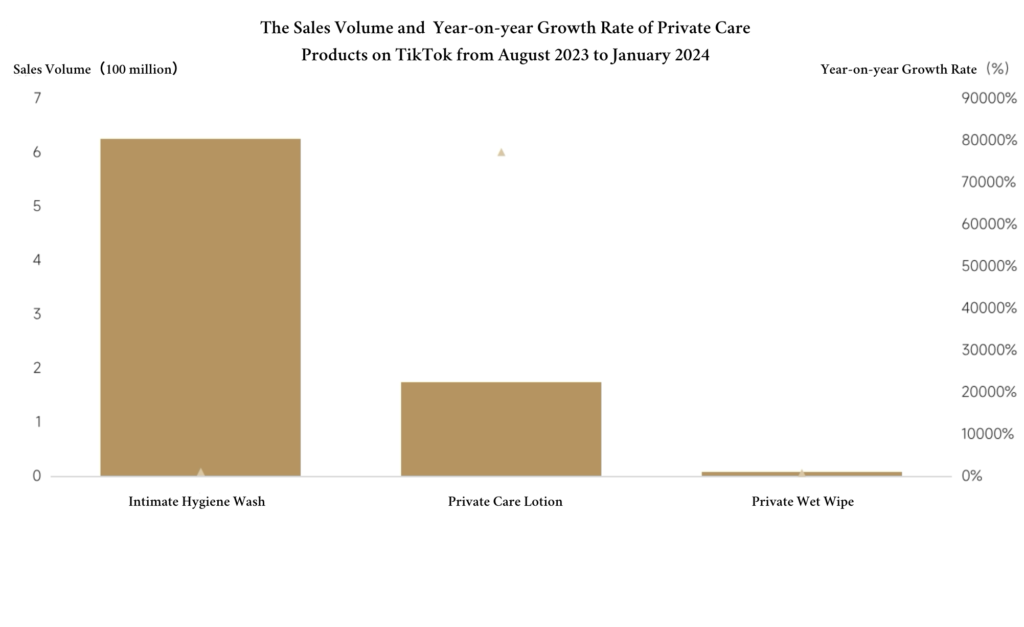

All subdivisions of the private care market are showing growth trends. The private wash market is relatively mature, with sales exceeding 500 million RMB from August 2023 to January 2024. However, the private care market is growing at an ultra-high rate of 77,279.3%.

In the past six months, the number of brands in the private care market has grown from 22 to 71, and the number of products has increased exponentially to 885. Huge consumer demand is constantly attracting new brands to enter the market. In January 2024, the top 5 brand concentration rate in the private care market was 48.2%.

Currently, overseas brands dominate the market, but domestic brands are rapidly capturing market share with high growth rates. The domestic brand Basa Man, with a year-on-year growth rate of 1591.2%, has become a top 3 player in the market. It indicates that there are still opportunities for domestic brands.

Foot bath agents

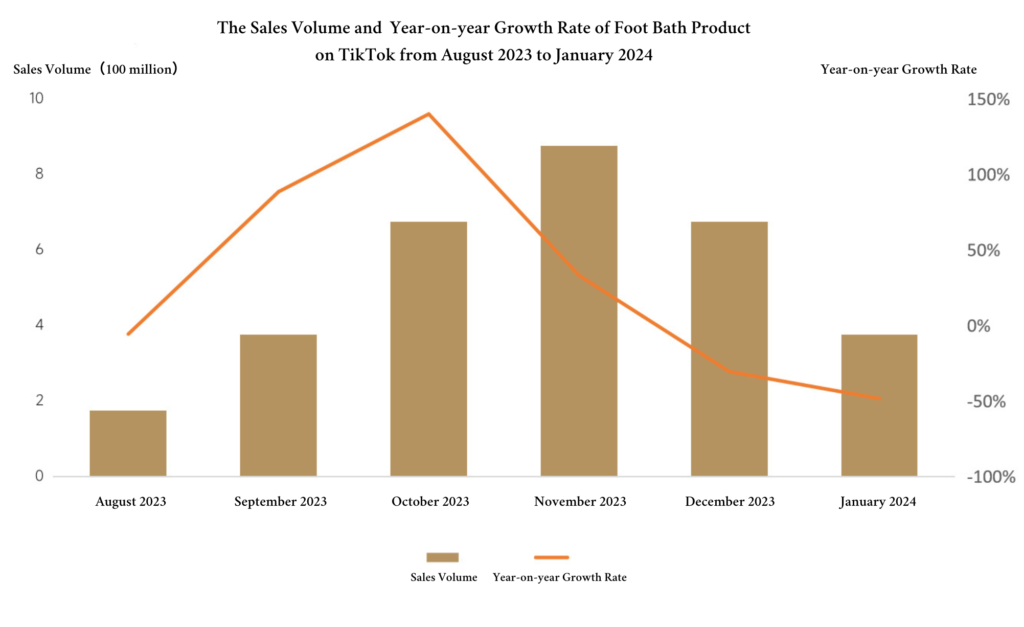

From August 2023 to January 2024, the sales of foot bath agents on the TikTok reached nearly 500 million RMB, with an increase of 97.38%. The sales performance of this category heavily relies on promotional events.

In January 2024, the number of brands in the foot bath agent market increased by 84.1% year-on-year, while the number of products increased by 156.0%. The number of related videos declined slightly, but the number of related live streams increased by 56.9%.

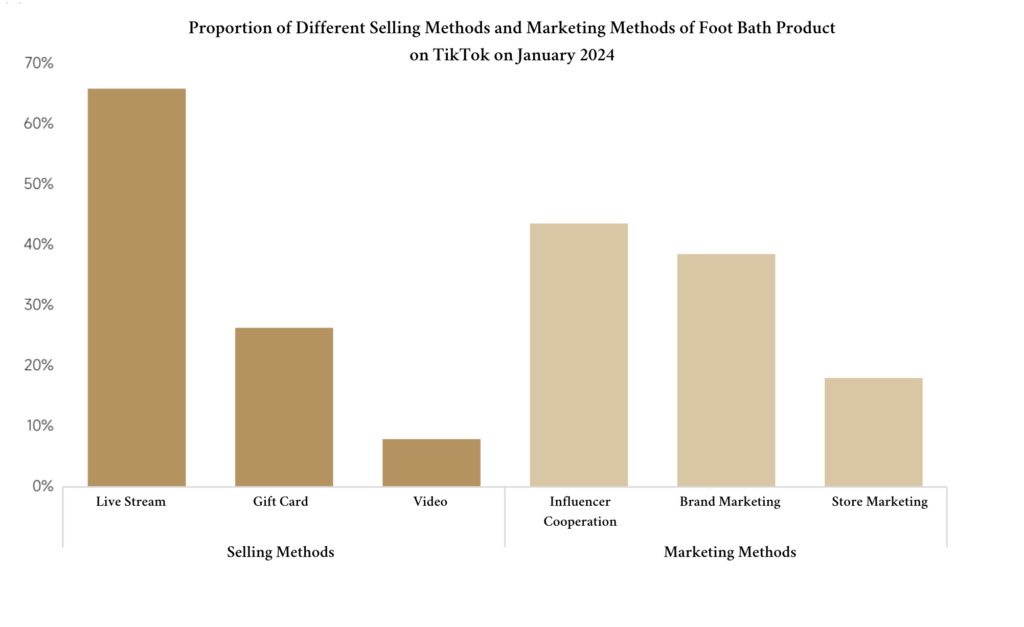

Brands are gradually shifting their sales focus to live streaming. In January 2024, live streaming accounted for 65.9% of the sales methods for foot bath agents. The brand self-operated accounts and influencer collaboration accounts are becoming the main channels for sales. Live streaming by brands themselves is currently the mainstream marketing method in this market. It was supplemented by influencer endorsements to increase product exposure.

The demand for women’s health and wellness has become one of the drivers of growth in the foot bath agent category. Concepts such as no-boiling, uterus warming, and cold elimination all have achieved a year-on-year growth rate of over 200.0%. Brands can further explore these functional needs and aim for more convenient and effective product iterations.

Hair care essential oil

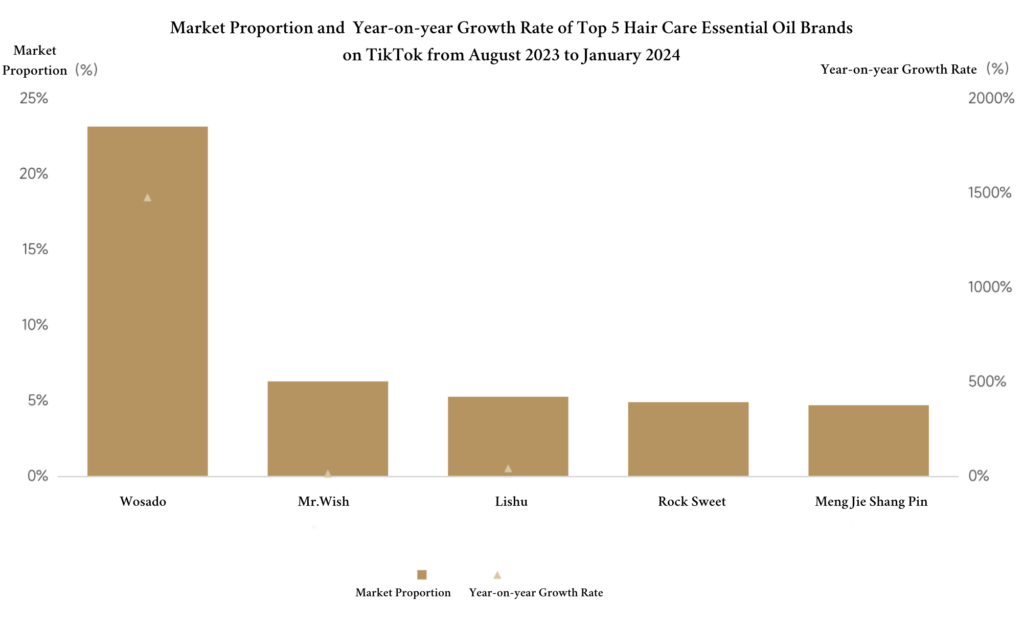

The concept of “skin care-style” hair care has gradually become popular. Consumers are increasingly demanding advanced functional benefits in hair care. Overall, shampoo, as a rigid demand category, dominates the market. The scale of hair care essential oil category is nearly 500 million RMB, with a relatively high sales growth rate of 82.37%.

Liruxu occupies the top spot in the hair care essential oil market on the TikTok. This brand differentiates itself with its “spray essential oil”, targeting the point of greasy texture. It focuses on being non-greasy, lightweight, and easy to absorb, achieving a year-on-year growth rate of 1478.29%, surpassing many overseas brands to take the lead.

Although consumers already have a high level of awareness of hair care essential oils, there is still room for further segmentation and product iteration within this category. For instance, scalp essential oils focusing on scalp care, small packaging and disposable essential oils targeting travel scenarios, and more refreshing essential oil sprays.

Maternity Products

Maternity skin care

Women are paying increasing attention to the importance of facial care during pregnancy and childbirth, and they have higher demands for the professionalism, safety, and effectiveness of skin care products.

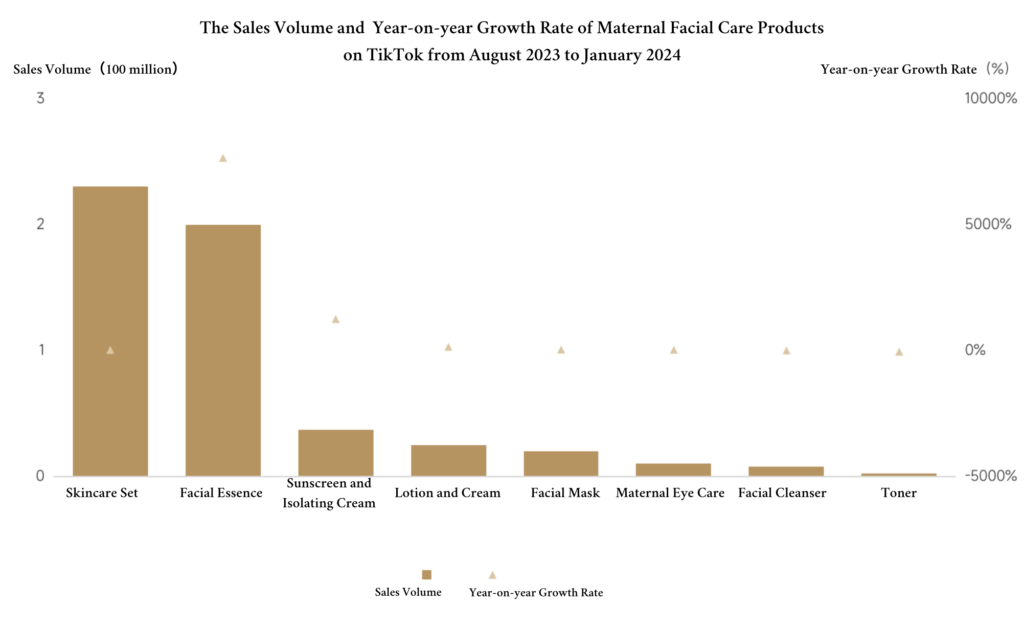

From August 2023 to January 2024, the market for maternity skin care, hair care, and stretch mark removal products on the TikTok grew by 118.9% year-on-year. Most of the facial care categories shown good growth momentum. The facial essence category, with a scale close to 300 million RMB and a year-on-year growth rate of 7652.7%, is particularly noteworthy.

Its strong functional essence products can address specific skin issues and meet the diverse skin care needs of pregnant women. In the maternity facial essence market, there are fewer brands.

In January 2024, the top five brands accounted for 98.7% of the market share, with Jiaorunquan, Zhiwu Zhuyi, and Kangaroo Mama ranking at the top. Their products are mainly bottled and disposable essence liquids.

The maternity facial essence market is still in its infancy, with a small number of brands and low competition. Brands can enter the market through the essence category, establish a professional and safe brand image, and gradually extend their layout to other maternity skin care categories.

Maternity pants

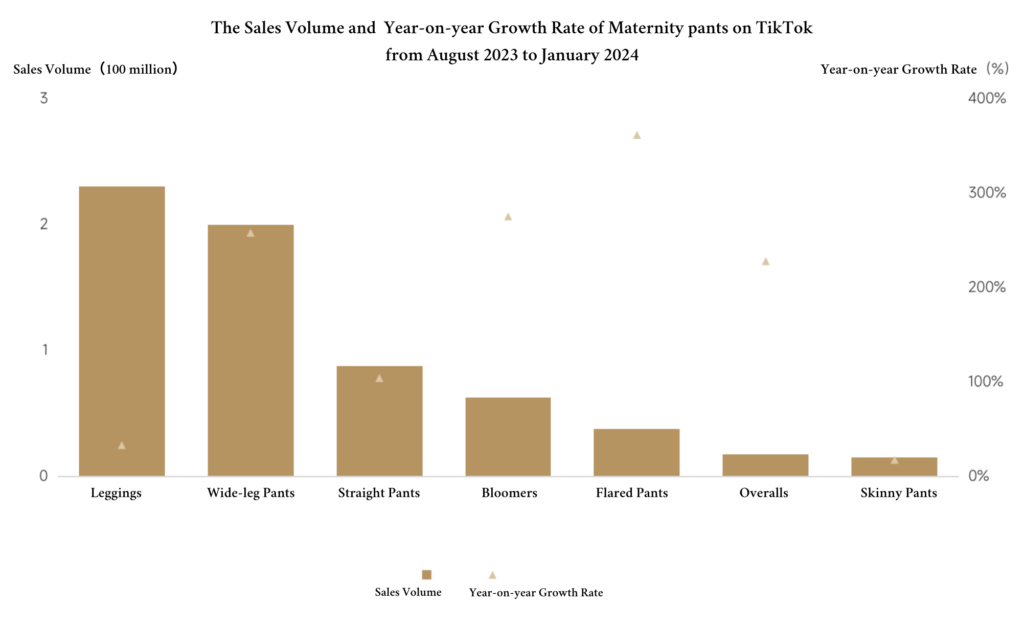

The rise of new maternity and childbirth concepts has also given rise to the demand for functional maternity wear, with more diversified needs for different occasions and more segmented maternity clothing categories.

From August 2023 to January 2024, sales of maternity pants/belly support pants on the TikTok exceeded 500 million RMB, with a year-on-year growth rate of 96.3%. In terms of segmented categories, maternity leggings occupy a dominant position, with a category scale of nearly 250 million RMB. The maternity wide-leg pants category has a higher growth rate, with a year-on-year increase of 258.1%.

In January 2024, the top five brands in the maternity pants/belly support pants market accounted for 24.6% of the market share. It indicated that a relatively fragmented brand competitive landscape and opportunities for small and medium-sized brands to enter the market.

In terms of product selling points, based on comfort, the functional demands such as good appearance and slim fit are growing rapidly. Concepts such as side slits are experiencing a growth rate of over 800%. Satisfying the wearing needs of beautiful pregnant women with comfort and good appearance can be a breakthrough direction for emerging brands.

Conclusion

In conclusion, as the economy slows down and consumption becomes more segmented, the competition in niche markets is just beginning. From the perspective of consumers, there are still many “golden consumption tracks” to be explored by finding opportunities in more segmented racetracks. Women occupy a significant portion of the consumer market and often play a leading role in consumption trends.

In the current consumer market, self-gratification, individualization, and appearance have become the characteristics of female consumption and the times. Under these characteristics, a series of niche categories such as lip care and hair care essential oils have emerged. Only by seizing the opportunities in the female consumer market and leveraging small niches to achieve big results can brands thrive against the trend.

Keywords:

| maternity store niche product categories[1] |

| incremental growth strategies for maternity stores[2] |

| she economy opportunities for maternity and baby shops[3] |