Gel flowers with fragrance become a hit in the toilet field; wet toilet paper outperforms the overall market for hygiene paper products. It is obvious that home cleaning products has become an important fulcrum for driving consumer market growth and economic recovery.

According to Nielsen IQ’s Retail Industry New Product Trends Report in 2024, the growth of home cleaning product was faster than all other categories in 2023. The latest report from Kantar Consumer Index also shows that the home cleaning category maintained considerable growth in 2023.

At the same time, the 2024 Online Consumption Trends Report on Household Cleaning released by JD Consumption and Industrial Development Institute indicates that multiple subdivisions within household cleaning products experienced rapid growth in consumption in 2023. This positive growth momentum is not only sustaining but also, fueled by its frequent usage and disposable nature, continually expands the realm of new consumer growth.

According to Frost & Sullivan data, the size of China’s home cleaning and care market was approximately 133.4 billion yuan in 2022 and is expected to reach 167.7 billion yuan by 2024, with a compound annual growth rate of 8.7%. This rapid growth trend is expected to continue in the coming years. It’s worth noting that the rapidly developing home cleaning products may be an golden opportunity that offline maternity and baby stores need to seize.

Fast-emerging Home Cleaning Products

The active growth of the home cleaning sector in the consumer market is primarily driven by two factors.

Firstly, people’s changing lifestyles in the post-pandemic era have led to increasing demands for home environments. Health, efficiency, and quality have become the core keywords. For example, in the field of clothing cleaning, new functional products have attracted more attention. In the field of home cleaning, consumers value product safety and convenient cleaning experiences. In the field of cleaning tools, consumers prioritize strong practicality and high cleaning efficiency.

Secondly, the arrival of the era of strong functionality has given rise to consumer demand for segmented populations and refined functionality in the home cleaning sector. As home cleaning brands, they now need to cater to the needs of different groups such as mothers and babies, sensitive skin users, pet owners and so on. They also need to fulfill scenario demands like travel and camping, as well as emotional demands like fragrant scents.

The continuous iteration and refinement of consumer demand for home cleaning products have opened up tremendous opportunities for category innovation and market expansion. The wet toilet paper is a typical example, experiencing a steep growth curve in a short period of time.

The 2022 Home Cleaning Industry Consumption Trends Report shows that the consumption amount of wet toilet paper in 2021 was four times that of 2019. The 2023 Wet Toilet Paper New Consumption Trends White Paper reveals that consumers are rapidly shifting from traditional dry paper products such as tissues and flat toilet paper to the wet toilet paper, with inflowing consumers growing at an annual rate of over 30%.

Highly-matched Retail Channel

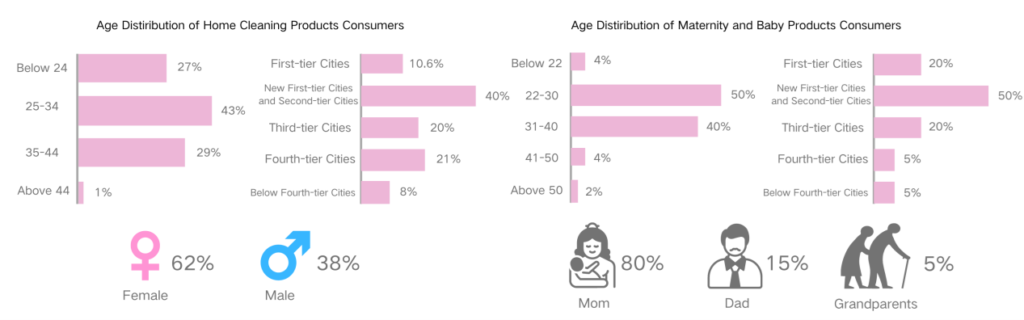

For maternity and baby stores, can they capitalize on the growth dividend of the home cleaning products? Absolutely. Firstly, the consumer demographics of maternity and baby stores align closely with those of the home cleaning products.

The 2022 Home Cleaning Industry Consumption Trends Report identifies four main consumer groups in the home cleaning sector: the Z-generation who prioritize humanized needs, female-dominated refined lifestyle enthusiasts, cost-conscious housewives, and practical male homemakers. These individuals are not only the main consumers in the maternity and baby market but also the primary demanders and decision-makers for home cleaning products.

Taking wet toilet paper as an example, the China Wet Toilet Paper Industry Status Deep Research and Investment Prospect Prediction Report (2022-2029) reveals that the current market structure of wet toilet paper is mainly concentrated in women and baby, accounting for nearly 80% combined. Among them, wet toilet paper for babies accounts for 48.23%, and wet toilet paper for women accounts for 31.45%.

Although the number of newborns is declining, the growth of the wet toilet paper market has not been significantly impacted due to its low penetration rate. Moreover, in terms of clothing cleaning categories, women and babies are the core target audience for refined care products. This gives more potential to categories such as laundry detergent for underwear and baby enzyme laundry detergent.

Secondly, in terms of channels, despite the intense competition in the home cleaning and care sector, offline sales still account for a large proportion, at approximately 70% of the overall market. This is due to the high degree of homogeneity among home cleaning products, often relying on channel push for sales, giving offline channels a certain degree of discourse power.

In conclusion, whether considering market growth potential, consumer demographics and channel alignment, or the consumable nature of the products themselves, home cleaning products is an important category that offline maternity and baby stores can explore and capitalize on.

Keywords: