As the market wanes and pain points become more pronounced, every player in the mother and baby industry is seeking such an opportunity to reverse the trend, especially at children’s outdoor clothing market.

To precisely identify the most recent developments in the mother and baby sector and elucidate category opportunities, CBME Insight and Chan Mo Fang have jointly launched the ‘[Interpretation of maternal and baby industry data]’ series. This initiative selects high-potential categories within the mother and baby industry monthly, offering data-driven, visual insights as decision-making resources for both brands and distribution channels.

In this first issue, our focus is on the children’s outdoor clothing category. The following article will elaborate on the specific data and analysis in detail.

The core segment of children’s outdoor clothing

Year-on-year sales growth reached 227.06%, with noticeable seasonal fluctuations in sales revenue.

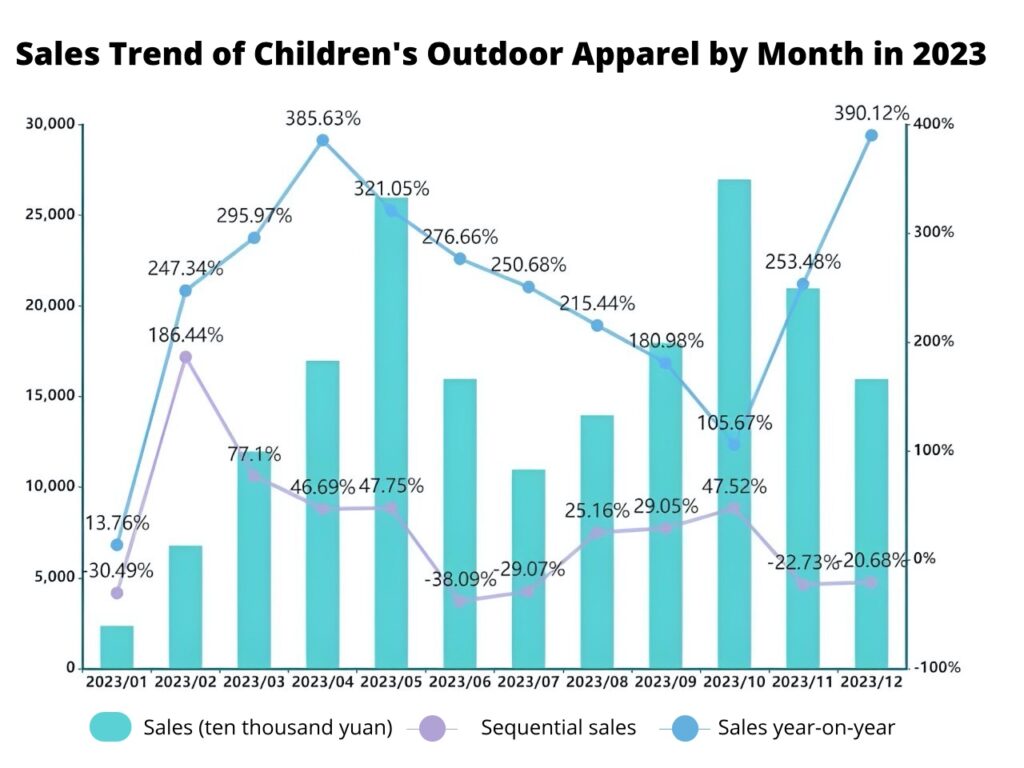

The Children’s Outdoor Clothing Sector Overview In 2023, the children’s outdoor clothing segment experienced robust growth. Chan Mo Fang reports that annual sales in this category neared 2.5 billion yuan, marking a substantial increase of 227.06% compared to 2022.

A noteworthy observation: The sales of children’s outdoor clothing exhibit a strong seasonality pattern. Data indicates that during March to May and August to October each year, there is a significant surge in sales. In contrast, the sales figures dip into negative territory in the periods preceding and following these two peak seasons.

In terms of item count, throughout 2023, the monthly item count of children’s outdoor clothing showed an overall upward trend, in January 2023, the value was nearly 4,000, and in December 2023, the value was over 14,000, an increase of 280% +.

In addition, the average transaction price for Kids Outdoor Clothing was at $54.14 for the entire year of 2023.

Which items sell well?

The sales revenue for children’s waterproof jackets is the highest, while the market size for products featuring fleece lining is the largest.

By category, in 2023, children’s rushing clothes have the highest sales, with more than 500 million yuan in sales, accounting for nearly 30% of sales, followed by children’s skinsuits/sunsuits, children’s fleece jackets, and children’s quick-drying pants.

In terms of selling points, according to the order of market size, goods containing “padded” selling points will have the largest market size in 2023, with sales close to 300 million yuan and a year-on-year growth rate of 122.17%; followed by “breathable”, with a market size of more than 260 million yuan in 2023, and a year-on-year growth rate of 122.17%; and children’s skinsuits/sunsuits, followed by children’s fleece jackets and children’s quick-dry pants. The second is “breathable”, with a market size of more than 260 million yuan in 2023 and a year-on-year growth rate of more than 419%; “leisure” ranks third, with a market size of more than 260 million yuan in 2023 and a year-on-year growth rate of more than 565%.

It is worth noting that among the Top 10 selling points, the keyword “loose” has the fastest year-on-year growth rate of over 854%, followed by the keyword “thin”.

Price band distribution, 10-50 yuan products, sales accounted for the highest, nearly 60%, followed by the price band in the 50-100 yuan products, accounting for 27.94%.

Which brands win the hearts and minds of the people?

The brand BOBDOGHOUSE boasts the highest sales revenue across its categories, while the growth rate of BANANA UNDER has been the most robust year-on-year.

Cicada Magic shows that, in order of category sales, BOBDOGHOUSE had the highest category sales for the whole year of 2023, followed by Turbo Kids, moodytiger, BANANA UNDER, SNOOPY, Hush Puppies, Disney, and so on.

It is worth noting that among the Top 10 brands in terms of category sales, BANANA UNDER had the strongest year-on-year change in sales growth rate of 113,315.55%, followed by BOBDOGHOUSE, with a year-on-year sales growth rate of 9,900.31%.

What should brands do?

Live streaming contributes significantly to the main sales revenue.

In 2023, live broadcasting became the main source of children’s outdoor clothing sales, contributing sales between 1 billion and 2.5 billion yuan, accounting for 79.2%; followed by merchandise cards, contributing sales of 250 million to 500 million yuan, accounting for 13.36%.

On the distribution of Jitterbug’s carry channel, the sales contributed by Darren’s cooperative number was the highest in 2023, reaching 500 million-750 million yuan, accounting for 43.65%, followed by merchant’s self-owned number and brand’s self-owned number, and the latter two accounted for nearly the same proportion.

In addition, the share of these three carry channels is basically the same as the distribution of the share in 2022.

Where are the target users?

Consumers in Guangdong Province exhibit the strongest purchasing intent, with the age group of 31-40 becoming the primary force driving consumption.

In 2023, the geographical distribution of the TOP15 is topped by consumers in Guangdong with 13.65%, followed by Henan, Shandong, Hunan and Jiangsu provinces.

In the distribution of age groups, people aged 31-40 years old are the main consumers, accounting for 49.25%, followed by consumers aged 24-30 years old, accounting for 32.25%.

Keywords:

| CBME children’s outdoor clothing market trends[1] |

| CBME high-performance outdoor wear for kids[2] |

| Global sourcing for children’s outdoor clothing at CBME[3] |